Introduction

Imagine looking at your current inventory and wondering if your supplier truly understands where the biggest growth markets lie. You might have questions about which destinations promise the strongest demand, or how to strategically align your offerings with the right regions. Perhaps you’re unsure if relying on a few familiar markets leaves potential profits untapped. You might be wondering if there’s a global snapshot that reveals which countries buy more, which regions value quality above all else, and how shifts in trade policies shape the entire landscape. By understanding where impact socket manufacturers export the most, you’ll be well-positioned to guide your brand toward stable, long-term success.

The Role of Impact Socket Manufacturers in Global Trade

Understanding the Significance of Manufacturing Hubs

Impact socket manufacturers hold a critical place in the global tool economy, as their products serve professional mechanics, industrial operations, and everyday DIY enthusiasts. In various production hubs—such as China, Taiwan, Japan, and the United States—factories consistently refine techniques to produce sockets that offer strong torque resistance, durability, and long-term reliability. These centers of production typically combine cutting-edge machinery with skilled labor to meet widespread demand. It’s essential to recognize that manufacturing excellence requires not only precise engineering but also the willingness to adapt. As global needs evolve, manufacturers experiment with new materials, coatings, and testing methods. The result: factories positioned at strategic locations, each aiming to balance cost, quality, and timely delivery.

OEM vs. Brand-Centric Approaches

When exploring the role of these manufacturers, consider how two primary models work hand in hand. Some factories specialize as OEM producers, quietly supplying renowned brands with finished goods. Others establish independent brand identities, investing in marketing and distribution networks. Here’s the deal, OEM capabilities increase a factory’s appeal to buyers seeking customization, unique labeling, or tailored packaging. By contrast, a brand-forward approach might garner customer loyalty and name recognition, leading to direct export relationships with wholesalers or retailers eager to stand out.

Quality Control and International Standards

As global trade intensifies, impact socket manufacturers embrace stringent quality benchmarks. They may align with ISO or DIN standards, ensuring consistency and reliability across shipments. Buyers from North America, Europe, and Australia care deeply about whether sockets meet well-defined specifications. You might be thinking, does this attention to quality matter everywhere? Absolutely. Over time, clients from emerging markets also gain sophistication and demand better performance. Maintaining rigorous testing, third-party inspections, and traceability not only earns trust but also paves the way for wider exports.

The Global Web of Suppliers and Exporters

These manufacturers often navigate a complex network of suppliers for raw materials and distributors who connect them to buyers around the world. Strategically selected supply chains ensure timely production and minimal downtime. Guess what, the manufacturer’s standing in global trade emerges from careful alignment of talent, technology, and relationships. Even subtle improvements in product design, packing methods, or shipping logistics can tilt the scales in competitive global markets.

Mapping Global Demand for Impact Sockets

Geographic Preferences and Industry Drivers

Impact sockets find their way into countless settings: automotive workshops, heavy machinery repair stations, construction sites, and even simple home garages. Different geographic markets exhibit unique preferences. North America values durable, high-quality tools that last under punishing torque, while Europe’s focus might tilt toward environmentally compliant, precisely engineered sockets. Australia’s mining and agricultural sectors prefer heavy-duty tools that endure challenging conditions. Here’s the deal, mapping demand involves more than just counting orders; it means understanding who uses these tools and why.

Automotive, Industrial, and DIY Consumers

One might notice a spike in exports to regions known for robust automotive aftermarkets, such as the US and parts of Europe, where car culture thrives and professional garages constantly need replacements. Heavy industries like construction or mining spark demand in countries investing in infrastructure. Meanwhile, the rise in DIY projects worldwide pushes retailers and e-commerce sellers to seek reliable impact sockets for everyday users. You might be wondering, how does this translate to export patterns? Regions with mature automotive sectors often top the charts, whereas those undergoing infrastructure booms place steady recurring orders.

Seasonal and Economic Cycles

Demand doesn’t remain static. Certain times of the year—like the onset of construction seasons—can boost purchases. Economic booms or slowdowns in certain countries affect how aggressively buyers import tools. Consider emerging markets ramping up vehicle ownership and industrial production; as their economies grow, so does their appetite for quality tools. Here’s another thing, shifts in global supply chains, currency fluctuations, and trade regulations also influence where shipments land.

Technology’s Growing Influence

Automation and digital platforms equip manufacturers with better insights. By monitoring global inquiries, sample requests, and feedback, they pinpoint promising destinations. You might be asking, does technology alone determine export hotspots? Not exactly, but it’s a valuable tool for refining strategies and reacting quickly to changing preferences. Over time, data-driven approaches help pinpoint steady customers and underserved regions, guiding companies to diversify or double down on particular markets.

Top Export Destinations for Impact Socket Manufacturers

The United States: A Major Market with High Standards

For many manufacturers, the United States ranks among the top export destinations. Its large network of automotive garages, industrial maintenance companies, and DIY consumers fuels a constant need for dependable tools. This strong demand, combined with established distribution channels and broad access to online marketplaces, makes the U.S. a lucrative, though competitive, target. You might be wondering, what sets the U.S. apart? Strict quality demands, the willingness to pay for premium performance, and a culture of brand recognition.

Europe: Diverse Markets with Stringent Requirements

Europe represents a patchwork of countries, each holding distinct preferences. Germany might prioritize precisely engineered tools that pass rigorous performance tests, while the United Kingdom values trusted brands and warranties. Southern European markets may seek cost-effective yet reliable solutions. Navigating Europe means meeting compliance standards like CE markings, environmental regulations, and detailed labeling requirements. Here’s the deal, success often comes from adapting products and marketing messages to satisfy varied cultural expectations and technical norms.

Australia and New Zealand: Niche but Stable Demand

Though smaller in population, Australia and New Zealand maintain consistent demand for impact sockets, especially within industries like mining, agriculture, and forestry. Their emphasis on quality and durability reflects challenging operating conditions. Manufacturers who appeal to these markets understand the importance of tools that stand the test of harsh environments. You might be thinking, are these niche markets worth pursuing? Absolutely. Steady, long-term relationships often emerge from buyers who appreciate reliability and support.

Emerging Hotspots: Middle East, South America, Africa

Beyond established markets, several regions show growing interest in impact sockets. The Middle East’s infrastructure projects and vehicle fleets push demand upward. South American countries experiencing industrial growth begin to invest more in professional-grade tools. Meanwhile, African nations, as their economies mature, gradually open up opportunities. Guess what, early movers who forge connections in these emerging territories may reap long-term benefits, especially if they tailor offerings to local needs.

Factors Influencing Where Manufacturers Export

Trade Policies and Tariffs

Global trade doesn’t exist in a vacuum. Tariffs, quotas, and trade agreements shape where manufacturers choose to export. For example, favorable terms with the European Union might prompt factories to lean heavily on that region. Political shifts—such as new tariffs or stricter customs inspections—can either encourage or discourage shipping products to certain places. You might be asking, do these policies change often? Sometimes yes. Manufacturers must stay alert to evolving regulations, negotiating carefully with distributors and freight forwarders.

Logistics, Shipping, and Inventory Management

Reliable logistics underpins successful exporting. Factors like shipping costs, transit times, and port efficiencies matter. If goods get stuck at customs or face lengthy delays, buyers lose patience and may switch suppliers. Here’s the deal, proactive inventory management—like positioning stock in strategically located warehouses—helps manufacturers respond to orders swiftly. By collaborating with competent logistics partners, exporters mitigate risks, speed delivery, and enhance their reputation as dependable suppliers.

Currency, Payment Terms, and Financial Stability

Global buyers often pay close attention to currency fluctuations. A manufacturer might receive more inquiries when their local currency weakens, making their goods more affordable abroad. Conversely, stable payment terms and secure transaction methods assure both parties. You might be wondering, does financial trust factor into export decisions? Absolutely. Trust in getting paid on time and in full influences which regions gain priority, encouraging long-term cooperation over one-off deals.

Cultural Nuances and Communication

Clear communication paves the way for successful exports. Understanding cultural preferences, language barriers, and local business etiquette can determine if relationships thrive. Some buyers appreciate detailed product manuals in their native language or prompt after-sales support. Here’s another thing, exporters who adapt marketing materials, instructions, and customer service approaches find it easier to secure repeat business. Even small gestures—like responding quickly to emails or providing product training—build confidence and loyalty.

Identifying Top Players in the Industry

Leading Global Brands and Their Key Markets

Household names like Snap-on, Makita, or Stanley often command strong presence in established markets. They leverage brand loyalty, recognized certifications, and proven performance records to remain top choices. You might be thinking, do only big brands succeed? Not necessarily. Smaller or specialized manufacturers can also thrive by offering unique customizations, appealing pricing, or niche products that larger brands overlook.

Specialized OEM Factories

In recent years, OEM factories from China and other Asian countries have risen in prominence. These highly adaptable producers cater to buyers who want to label tools under their own brands. With flexible production lines, thorough quality controls, and responsiveness to client demands, they attract e-commerce retailers, distributors, and even local tool shops worldwide. Here’s the deal, OEM factories stand out by helping customers differentiate their products, test new designs, and meet targeted market segments.

Regional Champions and Hidden Gems

Beyond global giants, certain regions boast local champions that excel in particular niches. For example, a Taiwanese factory might refine certain socket types that excel in marine environments, attracting coastal and shipping industries. A small European workshop might focus on ultra-precise tolerances and innovative materials. You might be wondering, can these hidden gems scale up globally? Yes, given the right marketing and distribution alliances, their specialized offerings often carve out impressive export footprints.

Building Trust Through Certifications and References

In a world teeming with suppliers, trust emerges from proven credentials. Factories that present ISO certifications, test reports, and references from satisfied clients gain credibility. Over time, these signals persuade new buyers to take a chance. Guess what, success often begets more success. As exporters build a track record of consistent quality and reliable shipments, word spreads, and their influence in top markets grows.

Export Strategies That Work

Partnering with Local Distributors

One proven method for expanding exports involves aligning with knowledgeable local distributors. These partners understand their market’s language, cultural nuances, and buying patterns. They can guide product positioning, suggest pricing strategies, and handle after-sales support. You might be asking, does this reduce complexity? Absolutely. By entrusting local partners, manufacturers skip the learning curve of new markets and focus on consistent supply.

Utilizing Online B2B Platforms

E-commerce solutions and B2B marketplaces, like Alibaba, create windows into global demand. By listing products, offering samples, and engaging directly with potential buyers, manufacturers shorten the path to securing export deals. Here’s the deal, online platforms level the playing field, giving smaller factories access to international clients who may have never considered them before. With strong product descriptions, attractive visuals, and responsive messaging, suppliers stand out in crowded marketplaces.

Attending Trade Shows and Industry Fairs

Industry fairs and exhibitions remain vital for forging relationships. At these events, manufacturers meet distributors, retailers, and brand owners face-to-face, forging trust and clarifying expectations. Visitors can handle sample products, ask detailed questions, and negotiate terms on the spot. You might be wondering, is this old-school approach still effective? Absolutely. Personal connections often seal deals faster than emails, and follow-up conversations feel more natural after building rapport in person.

OEM/ODM Customization and Added Value

Offering custom designs or unique branding sets exporters apart. OEM/ODM arrangements enable buyers to differentiate themselves in competitive markets. Maybe they want sockets in a particular color or with laser-etched logos. Here’s another thing, customization options help establish long-term partnerships by embedding the manufacturer into the buyer’s brand identity. Over time, this strengthens client loyalty and encourages repeat orders.

Quality and Certification Requirements in Different Regions

North American Expectations

North American markets, particularly the U.S., rely on recognized standards like ANSI/ASME. Buyers demand testing proof, durability results, and reliable performance under significant torque. Meeting or exceeding these benchmarks isn’t optional; it’s the baseline for market entry. You might be wondering, how does meeting these standards help? Compliance reassures customers they’re receiving top-tier products that won’t fail under stress.

European Regulatory Frameworks

In Europe, compliance might mean adhering to CE standards, REACH guidelines, and sustainability criteria. Detailed labeling and instructions in multiple languages further demonstrate a commitment to local norms. Here’s the deal, addressing environmental concerns, restricting hazardous substances, and ensuring worker safety during manufacturing resonates positively with European clients, who value ethics and transparency.

Australian and Other Regional Requirements

Australia and nearby regions may request unique performance tests or favor specific metal treatments suitable for high-pressure, dusty, or corrosive conditions. You might be thinking, are these adjustments minor? Often they are subtle but crucial. Failing to meet these localized standards can derail trust. On the contrary, aligning with regional requirements proves that the manufacturer cares about practicality, reinforcing credibility among buyers.

Consequences of Non-Compliance

Falling short of quality standards can result in lost orders, damaged reputations, and difficulties reclaiming market share. In competitive global markets, customers have abundant alternatives. You might be wondering, is strict compliance worth the effort? Absolutely. By investing in testing, certifications, and audits, exporters secure a foothold that competitors lacking these credentials simply cannot match.

Pricing Strategies and Market Positioning

Balancing Quality and Cost

Pricing remains a delicate dance. While some clients happily pay a premium for top-notch tools, others focus on cost-effectiveness. Manufacturers must gauge where their product fits. You might be wondering, should we cut corners for cheaper pricing? Not necessarily. Instead, aim for the sweet spot between affordability and durability. Value-driven approaches appeal to segments that demand longevity rather than rock-bottom deals.

Responding to Raw Material Costs

Steel and alloy prices shift with global supply and demand. Manufacturers who manage these fluctuations effectively maintain stable pricing or explain necessary adjustments transparently. Here’s the deal, honesty about material costs fosters trust, helping buyers understand when slight price hikes aren’t profiteering but the result of global factors outside anyone’s control.

Bulk Orders, Discounts, and Long-Term Deals

Offering volume discounts encourages larger purchases from wholesalers and distributors. Entering long-term contracts with steady partners reduces uncertainty for both sides. You might be thinking, does locking into contracts restrict flexibility? Sometimes yes, but it also ensures stable demand and predictable revenue, enabling better inventory planning and resource allocation.

Differentiation Through Branding

If pricing competition gets fierce, branding and storytelling can tip the scale. By highlighting durability tests, customer testimonials, or eco-friendly packaging, exporters convince buyers that their higher price tag reflects genuine value. Guess what, consistent messaging about quality and reliability ultimately secures a loyal client base and protects against price-driven races to the bottom.

Navigating Supply Chain and Inventory Challenges

Mitigating Delays and Stockouts

Global distribution involves intricate logistics. Late shipments can ripple downstream, causing missed deadlines for retailers or project delays for end-users. Manufacturers who proactively manage inventory, forecast demand, and maintain safety stocks minimize these disruptions. You might be wondering, how does this affect trust? On-time delivery cements a supplier’s reputation, encouraging buyers to rely on their services repeatedly.

Warehousing and Distribution Hubs

Positioning inventory closer to key markets shortens lead times. Establishing regional warehouses or partnering with 3PL (third-party logistics) providers reduces transit costs and improves flexibility. Here’s the deal, even small adjustments in logistics can produce big wins in customer satisfaction. Quick restocking and predictable shipment times help maintain positive relationships.

Handling Customs and Documentation

Cross-border trade entails proper documentation, from commercial invoices to certificates of origin. Errors or missing paperwork can delay shipments significantly. Manufacturers who streamline documentation and partner with experienced freight forwarders navigate complex import rules with ease. You might be thinking, is it worth the effort? Absolutely. Smooth customs clearance means faster deliveries and happier clients, which translates into repeat business.

Contingency Planning and Supplier Diversification

When unexpected challenges arise—natural disasters, political tensions, or sudden demand spikes—having backup suppliers and contingency plans help maintain stability. Here’s another thing, agility in the supply chain can rescue an exporter from sudden disruptions, bolstering their overall credibility and reliability.

Marketing and Branding in Foreign Markets

Adapting Marketing Messages

What resonates with customers in North America might not work in Europe or Asia. Translating product listings, adjusting color schemes, and using culturally relevant imagery help buyers connect. You might be wondering, does localization make that big a difference? Absolutely. Familiarity fosters trust, as buyers feel seen and understood by the brand.

Leveraging Social Media and Influencers

In today’s digitally connected world, product demonstrations on YouTube, Instagram endorsements, or LinkedIn product showcases build awareness. Here’s the deal, engaging content that highlights product durability, user satisfaction, and easy maintenance spreads quickly. As online communities discuss tools, positive word-of-mouth amplifies a manufacturer’s reach at a fraction of traditional marketing costs.

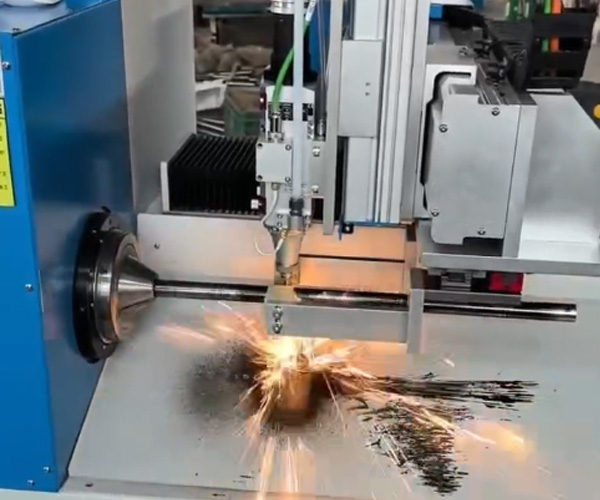

Showcasing Durability and Reliability

High-quality images, videos of stress tests, and documentation of performance under extreme conditions reassure buyers. You might be asking, do visuals matter that much? Indeed they do. A compelling video of a socket handling challenging tasks speaks louder than any product description. End-users envision themselves tackling tough jobs confidently, making them more likely to choose the product.

Building Brand Loyalty and Recognition

Over time, consistent messaging and reliable service cultivate loyal customers. These buyers trust the brand’s claims and return for repeat purchases, even recommending it to peers. Guess what, strong branding transforms one-time buyers into brand ambassadors who advocate for your tools in both online reviews and professional communities.

Technology’s Role in Identifying Export Hotspots

Data-Driven Market Insights

Modern exporters monitor trends using analytics tools. They track which regions request quotes frequently, which items sell best, and where customer satisfaction soars. You might be thinking, can data really replace guesswork? Absolutely. Analytics yield actionable insights that help refine targeting, streamline offerings, and predict demand swings.

E-commerce Integration and Online Catalogs

Listing impact sockets on global e-commerce platforms expands reach. Detailed product descriptions, specifications, and professional images guide decision-makers. Here’s the deal, by analyzing user behavior—like which pages they visit or how long they spend reading product details—manufacturers fine-tune offerings. This feedback loop drives continuous improvement and helps sharpen competitive edges.

Automated Production and Customization

Technology not only identifies markets but also streamlines production. Automated assembly lines reduce lead times and enhance consistency. You might be asking, does this lower costs? Often, yes. Lower production costs translate into pricing flexibility, which can appeal to emerging markets or encourage brand-building efforts in established territories.

Virtual Product Showcases and Samples

As in-person meetings become harder or costlier, digital showrooms and virtual samples help buyers understand products before committing. Here’s another thing, this approach shortens decision cycles and encourages potential clients to take that first step toward ordering a trial batch, ultimately boosting exports.

Building Long-Term Relationships with Global Buyers

Ongoing Communication and After-Sales Support

Sustained success hinges on more than just the first sale. Regular check-ins, timely responses, and helpful troubleshooting build trust. You might be wondering, do after-sales interactions matter? Absolutely. Buyers who feel supported remain loyal, renew contracts, and share positive feedback, drawing in more clients.

Feedback-Driven Improvements

As exporters gather user feedback—whether about minor product tweaks or preferences for different finishes—they fine-tune offerings. Here’s the deal, showing responsiveness to buyer suggestions cements partnerships. Clients appreciate feeling heard, which helps secure long-term business and mutual growth.

Loyalty Programs and Incentives

Encouraging repeat orders through discounts, exclusive deals, or priority access to new product lines rewards loyal buyers. You might be thinking, does this foster stability? Indeed. Loyalty programs transform a transactional relationship into a collaborative partnership, aligning incentives so both parties prosper.

Building Trust through Transparency

Sharing manufacturing processes, ethical sourcing, or sustainability initiatives proves that the company cares about more than just profit. You might be asking, does transparency pay off? Yes, it distinguishes a manufacturer as honest and conscientious, qualities that resonate especially in regulated or reputation-sensitive markets.

Future Trends in Global Impact Socket Exports

Emerging Technologies and Evolving Needs

As electric vehicles become mainstream, maintenance tools may shift. Infrastructure expansions in renewable energy or smart factories can spur demand for specialized sockets. You might be wondering, should exporters prepare now? Absolutely. Adapting early to new demands positions them as leaders when those sectors bloom.

Sustainability and Eco-Friendly Solutions

Conscious consumers and governments increasingly insist on greener products and packaging. Reducing environmental footprints, using recycled materials, or incorporating energy-efficient production methods earn goodwill. Here’s the deal, early adopters of sustainable practices may unlock new markets or secure niche advantages.

Geopolitical and Economic Shifts

Trade wars, emerging alliances, or sudden currency changes may alter export landscapes. You might be asking, can flexibility help navigate these storms? Indeed. Manufacturers ready to pivot, forge new alliances, or re-route supply chains demonstrate resilience that attracts stable partnerships even in uncertain times.

Continuous Innovation in Materials and Design

As research uncovers stronger alloys or advanced finishes, impact sockets gain longer lifespans and better performance. Here’s another thing, staying at the cutting edge ensures a manufacturer’s exports remain appealing, relevant, and indispensable across all markets.

Conclusion and Key Takeaways

Reinforcing the Main Message

From the United States’ robust demand to Europe’s quality-driven landscape, and Australia’s steady niche to emerging markets finding their footing, impact socket manufacturers face a world teeming with opportunities. Understanding where exports thrive isn’t about a single best market; it’s recognizing the nuanced tapestry of trade. You might be wondering, what’s the ultimate takeaway? Manufacturers who remain agile, prioritize quality, and respond to global signals secure enduring success.

Encouraging Action and Emotional Connection

By carefully studying their market, nurturing relationships, and embracing customization, exporters transform uncertainty into expansion. Consider connecting with trusted partners, asking for samples, or exploring data-driven insights. Visualize your brand’s sockets in garages, factories, and toolboxes worldwide. With knowledge and strategic thinking, you can guide your business to places where steady growth awaits and loyal customers appreciate every effort you make.

FAQ

How can I identify reliable impact socket manufacturers?

Look for suppliers with international certifications, references from long-term buyers, and transparent quality control measures. Request samples and test their responsiveness. You might be wondering, are references that important? Yes, they showcase track records and stable performance histories.

Which regions demand the highest-quality impact sockets?

North America and Europe frequently emphasize quality, durability, and compliance with strict standards. However, as global economies mature, many other regions also value reliability. Here’s the deal, investing in consistent quality pays off in multiple markets.

How do currency fluctuations influence export strategies?

Fluctuating currencies can make products cheaper or costlier abroad. Manufacturers who track exchange rates may adjust pricing or payment terms. You might be asking, is hedging useful? Sometimes yes, financial strategies help maintain stable profit margins.

Should I focus on established markets or explore emerging ones?

A balanced approach is often best. Established markets offer stability and guaranteed volumes, while emerging markets promise long-term growth. You might be wondering, is diversification risky? Diversifying helps mitigate reliance on one region.

What role does branding play in global markets?

Branding differentiates your product from generic options. Consistent messaging, compelling visuals, and authentic storytelling can justify higher prices and secure loyal customers. Guess what, strong branding transforms a functional tool into a trusted companion worldwide.